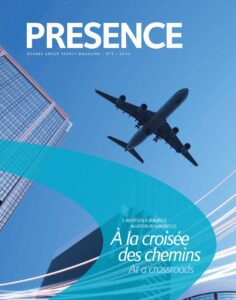

A witness and a contributor to the development of tourism in Mauritius, the former General Manager of MTTB looks back on some significant moments in the history of the sector.

The impact of fluctuations in fuel costs on pricing, coupled with the eurozone crisis, has made it even more difficult for the aviation sector to achieve profitability in recent years. Growth has been irregular despite relatively robust passenger demand, whilst freight traffic has declined. The effects of turbulence on the sector have been felt throughout the chain, not only by airlines and aircraft manufacturers, but also by travel agents, tour operators, hoteliers, car rental companies and others. As more than half of the 1,035 billion international tourists travelled by air to their destinations in 2012, it is very clear that the fates of the tourism and aviation industries are closely linked.

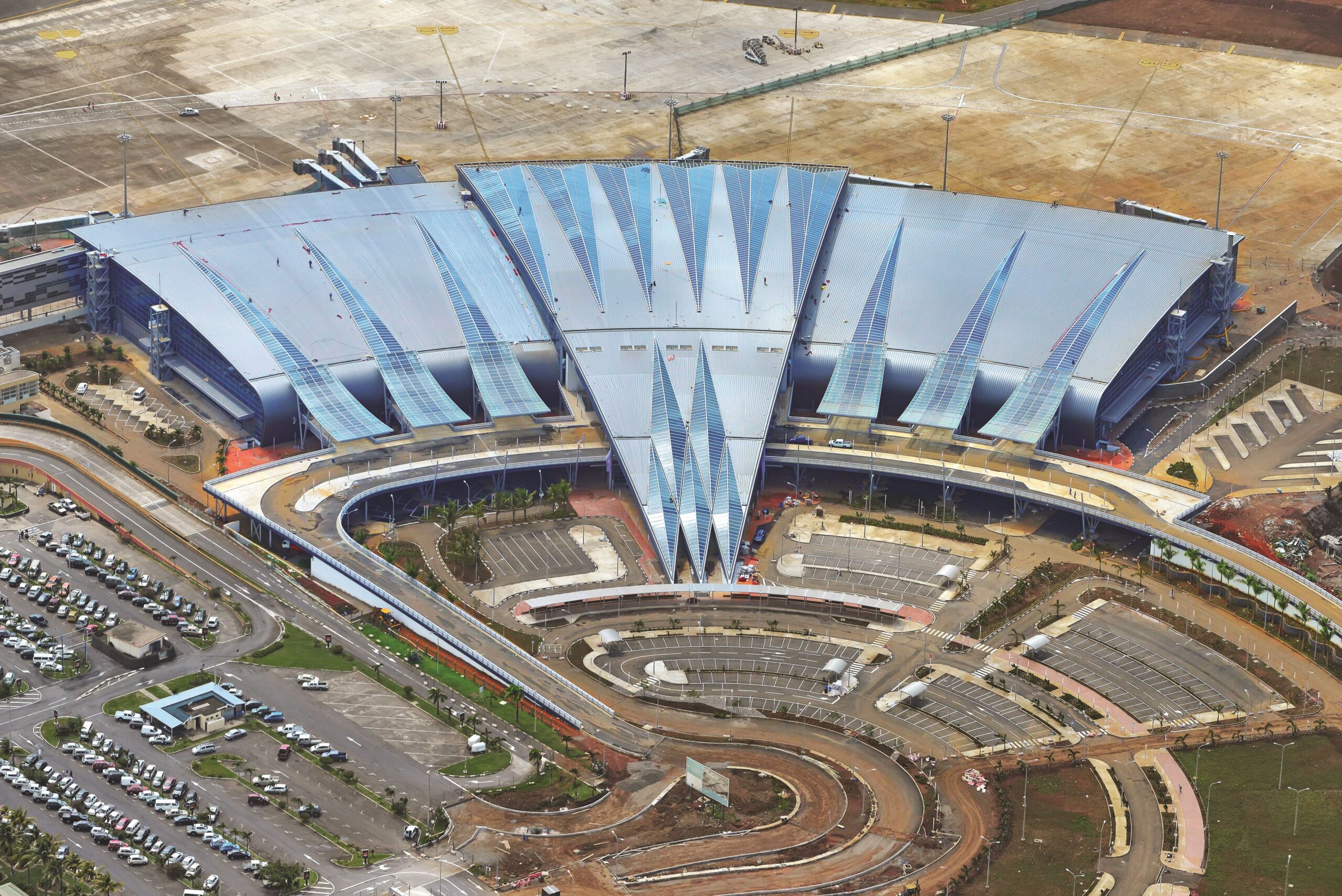

Sir Seewoosagur Ramgoolam International Airport, the main point of entry into Mauritius, currently serves some 20 or so airlines flying to more than 35 destinations. It recorded 10,016 aircraft landings in 2012 and

47,000 tonnes of air freight were also handled. Last year, there were 1,247,619 passenger arrivals by air and 1,243,243 departures, which represented 97% of all travellers to and from the country. The number of those resident in Mauritius travelling grew by 8% to reach 236,595, representing 18.4% of total departures. Tourist receipts are a vital source of income for Mauritius, expected to contribute 25% to GDP and revenue of Rs46.1 billion (a little over ¤1 billion) in 2013. Hotel capacity has increased in recent years, with 117 hotels, 12,527 guest rooms and 25,496 beds in 2012, a total of just over 4.5 million room nights. A further 5% increase is expected in 2013. However, room occupancy rates fell from 70% in 2010 to 62% last year. Infrastructure is being improved, new routes introduced and a brand-new passenger terminal will shortly be opened, able to handle as many as 4.5 passengers a year. Airports of Mauritius Ltd (AML) has also invested in the resurfacing and lengthening of the main runway, as well as the building of a new 2.2 km long emergency landing strip. The runway, now 3.4 km long and 75 metres wide can comfortably accommodate such large jets as the Airbus A380 and the Boeing 787. In 2013, projects to develop freight traffic will require an investment of Rs350 million (some ¤10 million).

Given that 965,441 tourist arrivals were registered in 2012, everything points to an excess in room capacity. However, there has been real growth in many tourist destinations. While the International Tourism Organisation (UNWTO) forecasts a growth in tourist arrivals globally of 3% to 4% in 2013, after 4% growth in 2012, arrivals in Mauritius have stagnated just under the million mark, with only 0.1% growth recorded last year, and the forecast for this year is around 2.5%, i.e. some 990,000 visitors.

Growth seems particularly weak if compared with the 18% growth registered by our South African neighbours in 2012.

In fact, there is a fall in arrivals from our traditional markets, which are mainly European. Those from France, which accounted for 27.1% of arrivals last year, fell by 13.2%. This drop was partially compensated for by growth in visitors from emerging markets, which showed strong growth internationally.

So what is the problem and what are the possible solutions? Is it a matter of the distance between Mauritius and our main markets, airline ticket prices, a problem of air access or of seat availability, or does it lie in the cost and positioning of our tourism products? Those involved blame each other. Things, of course, are not helped by the difficult economic environment or by fluctuating aviation fuel prices.

Given the economic climate, in the view of the International Air Transport Association (IATA), there is some way to go globally before things stabilise, even if structural adjustments have improved the chances of the aviation industry turning in a profit. Recent economic conditions are contrasting, with a deeper recession than forecast in Europe on the one hand and, on the other, a fall in oil prices. According to an IATA study released in April 2013, business confidence has risen since mid-2012 but the recovery, which led to accelerating passenger traffic, has levelled off over the last few months, particularly because of the deteriorating eurozone situation.

In Africa, average air transport growth could reach 5.2% in 2013, against 5.1% last year, according to the Secretary-General of the African Airlines Association, Elijah Chingosho. Ethiopian Airlines, the most profitable airline on the Continent for three successive years, saw a 25% increase in its passenger traffic in 2012. Despite the difficult aviation climate, the Ethiopian flag carrier with its fleet of 54 planes continues to add destinations and remain on course to reach a revenue target of ¤7.7 billion by 2025.

Like the majority of airlines, however, the Mauritian national carrier has experienced financial problems in recent years. To turn things round, Air Mauritius engaged the American firm, Seabury, to advise on its ways of operating. Since February 2012, the airline has introduced a new 7-step plan. The company, which handles more than 50% of Mauritius’ incoming and outgoing passenger traffic, has increased its seating capacity by 3%, handling 1,943,946 passengers between April 2012 and March 2013, and laying greater emphasis on emerging and Indian Ocean markets.

“The outlook remains challenging, not only for Air Mauritius, but also for the whole airline industry,” according to Andre Viljoen, Air Mauritius’ CEO. “Mauritius is also particularly vulnerable to destination competition, given its geographical position. On the other hand, there are emerging opportunities in alternative markets. We have seen robust growth particularly in African and Asian markets. The new Air Mauritius network reinforces access to these destinations (see also an interview with him on page 12). Whilst Air Mauritius has made an undeniable contribution to tourism development, to the opening up of the country and to the nation’s standing, times have changed. With the way things are currently evolving internationally, the aviation sector in Mauritius – and by extension tourism – finds itself at a crossroads. It is clearly necessary to reinvent a model that appears to have become obsolete, to arrive at a strategy integrating the needs of both the carrier and tourism operators in the interests of the nation’s economy.

Nirvan Veerasamy, Managing Director of the aviation leasing company, Veiling, and former CEO of Air Mauritius, has no doubt that Mauritius could survive without a national carrier. “The Maldives are a clear example in the region. However, having a strong and prosperous airline that serves the needs of the nation and the region is an extremely valuable asset that enables us to have some control over our destiny rather than be dependent on others. The issue of air access has often led to debates about Air Mauritius and I think that some arguments have been unfair.”

“We know that the world has moved East and is likely to remain like that for the foreseeable future. India, Russia, China and South-East Asian countries are leading the world in economic growth. Having one or more airlines that have daily flights to these countries’ major cities for the benefit of the region is a no brainer. If this airline can also offer non-stop services to Mauritius or the region, then it is bound to be a winning combination.” In 2012, moreover, China moved into first place in terms of tourist spending abroad.

Nirvan Veerasamy also feels that “We obviously have to open up the air access into Mauritius but not just Mauritius. It applies to the entire so-called Vanilla Islands.” This regional grouping is made up of Mauritius, Reunion Island, the Seychelles, Madagascar, the Comoros and Mayotte, with the aim of encouraging tourist traffic between them. “David Savy from Seychelles mentioned quite rightly, during a recent Indian Ocean Commission conference on regional connectivity, that there should be an open skies policy between the Vanilla Islands. How can we explain that we have a double daily to Dubai but restrictive access between Mauritius and Seychelles?”

He believes that regional policy-makers have to go much further than just opening the skies. They have to create a Schengen-like environment between the Vanilla Islands where a passenger arriving in Mauritius can travel to Reunion, the Seychelles, Madagascar and Comoros as a domestic flight. “We have to have the necessary courage to create a Free Exchange Zone between these countries and aviation will then be an automatic vector of growth.”

Speaking on aviation connectivity in the Indian Ocean region at the conference held in Mauritius in early

May 2013, the Mauritian Minister for Foreign Affairs, Dr Arvind Boolell, further pointed out that “The crisis has slowed down and reduced transactions, paralysing investment in the short term and forcing restructuring. In such a context, we have to be able to respond and accept, if necessary, structural changes, which may be difficult in the short term but which will produce long-term rewards. This is the trend throughout but particularly in the civil aviation sector.”

The conference was organised by the Indian Ocean Commission (IOC) and attended by more than 80 representatives from the civil aviation, air transport, tourism, and import/export sectors, and international organisations and development partners (including the European Union, World Bank, UNWTO, French Development Agency, IATA and the International Civil Aviation Authority). It ended with the adoption of a roadmap calling for the convening of a meeting between civil aviation and tourism ministers. During the same conference, Hannah Messerli, a World Bank tourism development expert, presented forecasts for Singapore. In her opinion, a doubling of tourist arrivals between 2014 and 2017 would enable the country to triple its income from tourism and the economy would grow by two to three points.

One of the main speakers at the forum, Jean-Claude de l’Estrac (the Secretary-General of the IOC), told PRESENCE that the current debate about civil aviation is by no means unique to Mauritius. “Everywhere in the world, national airlines are asking themselves the same question. How do you reconcile financial viability with the need to support the economies of the countries they serve?” The IOC, whose primary role is to facilitate and support the economic and commercial integration of member countries, as well as encouraging their full participation in trade globalisation, offered plenty of food for thought.

One idea was the creation of a single regional airline company. “All the companies in the region are in financial difficulty and they have all had to revisit their development strategies as well as their expansion plans,” as Jean-Claude de l’Estrac pointed out. “Some of them have had to abandon less profitable routes because of financial concerns and to make cost reductions. To meet the challenges of a difficult financial situation, they are adopting a strategy which may help reduce operating costs and assist profitability, but which may hamper the region’s overall economic strategy.”

Like Nirvan Veerasamy, he too wonders whether nowadays it is necessary to have a national airline. “In many countries, it is considered an old-fashioned concept and that we must look for viability, competitiveness and an opening-up, and not stick to a symbol of national sovereignty which seems trivial given the stakes involved. Having to protect a national airline flies in the face of policies encouraging international competitiveness. The national airline may benefit but the question has to be asked as to whether that really serves the national economy and the overall national interest.”

He said that rationalisation and remaining competitive are pushing airlines to work together, to develop partnerships, to make strategic alliances and to merge. He pointed out, however, that a total open-skies policy is not necessarily the best solution. There have been situations in the past where, without a national airline, some countries have experienced real difficulties.

Jean-Claude de l’Estrac reckons that it makes sense for four small airlines that are losing money to merge into a single regional – and thereby larger – airline, which would result in a viable operation, rather than dividing up an already restricted market. Of a billion tourists worldwide in 2012, only two million came to the Indian Ocean region. Other models suggested by the IOC are partnerships with other regional companies and the joint selection of a large international strategic partner to connect the region with as much of the rest of the world as possible. It also recommends the creation of a low-cost carrier – not to compete with existing airlines but one in which they themselves would invest – to handle inter-regional traffic. As the Secretary-General explains, “There are low-cost companies all over the world, but not in our region. It would enable us to travel more rapidly and at lower cost, and would encourage traffic between us.”

He admits, however, that such ideas would be relatively complicated to introduce as they have political implications. “They would represent dramatic changes in approach but make sense both financially

and economically.”

Meanwhile, with the opening of its new passenger terminal, Mauritius’ strategic positioning as a regional hub for passengers and cargo is taking shape. “Mauritius lies in a golden triangle at the crossroads between Africa, Asia and Europe. It is to meet these future geopolitical factors that the Mauritian government has chosen to optimise international traffic flow and access through the construction of a larger and more modern terminal in order to create a hub,” explains the CEO of Airport Terminal Operations Ltd, Bruno Mazurkiewicz (see also an interview with him on page 64). The focus of the whole debate is around the model best suited to balance the interests of an international or regional airline against the overall economy. What is certain, however, is that doing nothing is not an option.