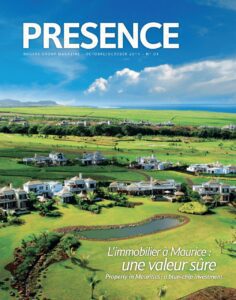

As well as being a sought-after holiday destination, Mauritius is also becoming the place for property investment, no longer the sole prerogative of local people and a lucky few foreigners who have acquired Mauritian nationality. There are now various schemes, open to foreign nationals looking for a quality way of life combining business opportunities with low tax rates, enabling them to invest in land and property in a country which, whilst still young, has also built up a reputation for its high level of investment protection.

photos : rogers image bank | alexa gordon-gentil

Property in Mauritius: a blue-chip investment

How many people had heard of Jean-Marie Gustave Le Clezio’s origins before he received the Nobel Prize for Literature in 2008? In fact, Mauritius has had plenty of successful authors, from Leoville L’Homme to Natacha Appanah, and from Marcel Cabon to Ananda Devi, Shenaz Patel, Amal Sewtohul and Alain Gordon-Gentil amongst others. Lovers of literature are able to delight in the literary outpourings from the island, glorified in the past in the writings of none less than Bernardin de Saint Pierre and Charles Baudelaire! Not so easily accessible, but very soul-stirring, the writings of Malcolm de Chazal are also worth looking at. Inspired by the scientific studies conducted at the beginning of the 20th century by Jules Hermann from the island of Reunion, the poet portrayed his homeland as one of the vestiges of a lost continent, Lemuria, in its time peopled with giants, sculptors of mountains. More prosaically, historians largely agree in stating that it was Arab sailors who first came to this tiny dot in the Indian Ocean in the 14th century.

Thereafter, from the 16th to the 19th century, it was variously disputed by the Portuguese, Dutch, French and British East India companies. The island has been “rediscovered” in recent years by tourists from across much of the world, who appreciate, amongst other things, the friendliness of the local people, the pleasant way of life and the fine beaches. They can also find luxury hotels, beautiful villas gracing some of the coastline and some fine buildings here dating from colonial times. Apart from these, however, Mauritius is not exactly known as a fine example of building styles.

Since the country gained its independence, its priority has been to see everyone decently housed, even if quality has sometimes had to take a back seat, sometimes to the detriment of a countryside which deserved better. Housing problems have not been completely overcome – is there anywhere where they have been? – but, slowly but surely, all the segments of the building sector are undergoing a real change.

Office buildings and commercial centres, which have been springing up like mushrooms close to the motorway in the centre of the island, are evidence of the change. Buildings in Mauritius, just as the land on which they stand, are valuable assets. As with many other areas of business activity, the Rogers Group has been a pioneer in this new area of economic development, positioning itself to provide new services, available to foreign investors, in commercial property and luxury housing.

Satisfied investors

How many tourists dream of buying a house whilst on holiday in Mauritius? Not necessarily to live there all the time, but just having one’s own place for regular get-togethers with family and friends. Perhaps with the hope of being able to sell it again one day without losing money and even seeing nice capital appreciation. And being able to let it out when not using it, as a way of recuperating some of the costs of the investment. And – why not? – passing it on to one’s offspring one day without any inheritance tax.

Since the law was changed, the one-time dream can now be turned into reality. Until recently, only Mauritian nationals could buy property here. Over the last few years, new provisions have been enacted so that foreigners can now invest in property.

Most such transactions are made under the Integrated Resort Scheme (IRS), generally integrated residential developments. Initiated at the beginning of the century, the scheme has already allowed the sale of more than 400 villas in five luxury residential developments, including two French ones. The Rogers Group has been involved in one of the five. Set on a site of some 520 acres in part of the Domaine de Bel Ombre – the destination in the holiday destination that is Mauritius, an estate that altogether covers seven to eight times as much land between the mountain tops and the ocean, the Villas Valriche will eventually include 288 villas. Buyers can choose from 22 different designs for one or two storey houses, all in a colonial style.

Surface areas range from 2,260 square feet (250 m²) for those with two or three bedrooms to more than 4,800 square feet (450 m²) for three and four bedrooms, which can even be built with a separate guest suite. All have an infinity pool and a covered garden sitting area with a food area and barbecue. They are built on various-sized plots, ranging from 7,500 square feet (700 m²) to more than 32,300 square feet (3 000 m²), laid out as tropical gardens. Each has elaborate finishings and is equipped with top-of-the-range appliances. They all have clear views of the golf course, the lagoon and the ocean as far as the eye can see. Buyers can choose from a wide range of options and interior designs so that they can personalise their homes.

Patrick Pearson, the owner of the first villa to be completed, says, “The villa far exceeds our expectations in every way”. “These villas make an excellent compromise,” adds Anne Pattenden, director of an international network of human resource consultants. Of American origin, she left Britain a few months ago, having lived there since the 1980s, to settle in the Domaine de Bel Ombre. She and her husband have chosen the site for their base, from which they work, as they have done for more than twenty years, in all four corners of the world – America, Europe, Asia and Australia. “We haven’t bought so much from an investment point of view. If we can make a profit when we resell, so much the better, but what we have been looking for is above all quality of life. It’s just as easy for us here as elsewhere to be in contact with our colleagues when preparing work. And when we have to go and see clients, we can easily take the plane as the country is well connected with the rest of the world”. She loves character houses and used to own manor houses from the 14th, 15th and 16th centuries in the United Kingdom. Fed up with the recent fiscal changes, she decided to liquidate her assets there in 2009 and to invest offshore in Mauritius. She has retained a pied-a-terre in South Africa but has chosen to live in Mauritius and more specifically in this part of the island, with which she fell in love when she came on holiday here a few years ago.

That’s also how things started for the Wilsons, a couple of South African early retirees. John and Jenny had careers in geological research, in the sale of equipment for mines and pharmaceuticals, a sector in which they still have interests in various countries in Africa. Having visited Mauritius several times on pleasure trips, staying in various hotels, they decided to invest here. Out of the various IRS projects, they settled on the Villas Valriche. They bought two, one for themselves and the other for their three sons and their wives and grandchildren, so that the whole family can get together during holiday periods. “The children still live in South Africa and we visit them there regularly. They have already come over for two two-week stays,” Jenny explains. She made the definitive move to her new home at the beginning of the year. “They envy us being able to spend so much time here. We love golf and the course on our doorstep is really amazing. We like the area, where we regularly go for walks, even if only to buy fresh food such as fish, fruit and vegetables in the neighbouring villages. People are so friendly. We really feel very safe here”.

As the new residents gradually move in, the initial development of 132 villas, 80% of which have been sold, is nearing completion. The Domaine de Bel Ombre where they’ve settled is becoming full of life, even if the owners are not always in residence themselves. Most of those for whom it is a second home are able to take advantage of the rental management system. The marketing of villa lets and the services available to those renting are done through the Heritage brand; in other words, the standard is five star. Those renting the villas in the owners’ have privileged access to the Domaine’s facilities, which include restaurants, being cooked for at home, a spa, beach club, golf course and fitness centre, children’s and teenagers’ clubs, walks and water sports. During their stay, people can also see for themselves the way the country’s economy is evolving, with the corollary of investment opportunities, particularly in commercial property which is undergoing unprecedented development due to changes in consumer practices and the increase in importance of services for companies. These phenomena encourage the creation of commercial centres and the construction of office buildings.

A commercial property fund listed on the stock exchange

Rogers has been a pioneer in the property sector, through its involvement during the course of the company’s long history in most of the productive sectors in Mauritius, whether in industry, the hotel business, the mass retail sector and, more recently, outsourced business services. Originally, its Foresite subsidiary was set up to meet internal needs. As is often the case, in-house expertise rapidly developed beyond its initial parameters.

The turning point came in 2008 with the purchase of the buildings in two shopping centres. Each is built around a hypermarket – amongst the largest in the country – operated under the Jumbo label, one of the regional subsidiaries of the French Casino group. With these acquisitions, Foresite Property now manages a total of more than 570,000 square feet (53,000 m²), of which 60% is used for commercial purposes, just under 30% is in industrial use and the rest occupied by offices. The company’s main strength lies in the occupancy rates. On average, they are close to about 92%, with 95% in the commercial sector, which has led to a rate of return of 34% and a return on investment of almost 20%.

Backed by these strong results, after a few months the Rogers Group went further and launched a new initiative – a first in Mauritius – in creating a property fund, open to the public, with shares quoted on the secondary market of the Port Louis stock exchange. Well-named, Ascencia has enabled capital to be raised for the development of the Group’s land and property holdings. An initial share flotation, which should shortly be joined by a second, continues to make subscribers happy. Besides the shareholders, who can see the value of their shares climb and who receive comfortable dividends, Ascencia has also brought satisfaction to those operating in rented buildings and the common areas in the modernised commercial centres. The first beneficiary has been the Phœnix one, in the centre of the island, which now has a fresh feel to it again.

Brand and shareholder happiness

The Phœnix Commercial Centre can take pride in nowadays being one of the most attractive in Mauritius. 20 years ago, the site welcomed the country’s first hypermarket and, since its renovation last year, new outlets have added to its lustre. The extended and new-look shopping gallery is bustling, with food outlets such as McDonald’s, Kentucky Fried Chicken and Pizza Hut, and brands such as Nike, Levi’s, Aldo and Guess. Some of the labels are the result of an agreement between the Mauritian group and Mercure International of Monaco (MIM), a major distributor of brand-name products in Africa, Europe and the Antilles.

As Louis Ingey, director of the local MIM subsidiary, has put it, “We greatly appreciate working with such a reliable and dynamic group, with the capacity to modernise and regenerate its set-ups, to bring them up to international standards. In Mauritius, MIM commercialises several major brands and international labels, for example Go Sport, Guess and Nike, as well as its own chain of shops, City Sports.

Whilst waiting to start the second phase of works at the Phoenix Commercial Centre and the renovation of the Riche Terre Commercial Centre to the north of Port Louis, Foresite Property also has other projects in the pipeline. On the drawing board, a mixed development of offices and commercial and residential property in a strategic area in the centre of the capital, of which Rogers has the land management, is to the forefront. At the right time, Ascencia funds will be used to launch the development. Much to the delight of its shareholders, no doubt, amongst which are Liberty Properties, the leading property fund in Africa, which has developed firm confidence in and has major hopes for the Mauritian market, convinced that it is a blue-chip investment.