The Rogers Group’s financial arm has strengthened its postilion in the sector with the acquisition of a majority stake-holding in two global business companies.

photos : deeneshen sabapathee | shutterstock

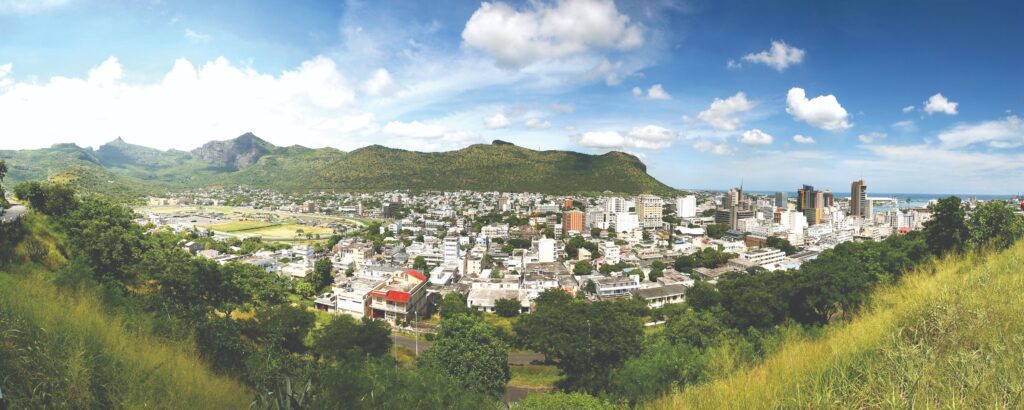

The financial and insurance sectors currently account for 10.3% of Mauritius’ GDP, recording 5.4% growth in 2014 and projecting the same for 2015. The future looks promising as a growing number of operators are interested in setting themselves up in various sub-sectors, ranging from global business (which brings in about half of the sector’s contribution to GDP) to investment banking, investment advisory, management and structuring, broking services and international legal services. The number of investment companies and international funds using Mauritius as a platform for investment in the region, particularly in Africa, is also on the rise.

Confirming the announcement made in the 2014 Annual Report by the Chief Executive Officer, Philippe Espitalier-Noël, to the effect that “new services will be proposed in the financial services sector to cater for the specific needs of local and regional institutional investors and high-net-worth individuals”, Rogers is making a strong return to financial services. The come-back was marked by acquisitions of majority stake-holdings in two global business companies, Consilex and Kross Border, early in 2015.

Rogers was a pioneer in the global business sector when it set up the first management company in Mauritius in 1992 and these initiatives are very much in line with the Group’s strategic intention to support the development of its financial arm, Rogers Capital, in adding to its critical mass. Through Rogers Capital, the Group’s financial services activities include asset and wealth management and advisory services.

The Group’s financial arm, which also includes Rogers Asset Management, provides a unique platform for investing in Africa and Asia. Rogers also holds a 28.8% stake in Swan General, as well as a 20% one in Swan Financial Solutions.

Complementary acquisitions

Rogers now has a majority stake of 76% and 70% respectively in Consilex and Kross Border. Both companies hold global business management company licences from the Financial Services Commission, the regulator for the non-banking financial services and insurance sectors in Mauritius. Kross Border’s network of chartered accountants is complemented by Consilex’s network of lawyers. The two companies now report to Didier Lenette, the Group’s Head of Global Business, who has a strong background as a chartered accountant and fiscal advisor. He was formerly Head of Tax at PWC, where he managed a portfolio of more than 500 clients and worked closely with a number of offshore management companies.