In the 16th century Mauritius straddled the trade routes with Asia. In the 21st century, the relevance of Mauritius has again come to the fore as an international financial centre of high repute which is rapidly becoming the investment fulcrum between Africa and India. A stable democracy since independence in 1968 and with a legal system that has the Privy Council of the House of Lords of the UK as its Court of final appeal, Mauritius offers the political stability and legal certainty that is required by international investors.

photos : rogers image bank

This is supported by the Organisation for Economic Co-operation and Development (OECD) white-list status and a framework of investor friendly legislation and competent regulation. More than 40% of Foreign Direct Investment into India flows via Mauritius and increasing volumes of investment into Africa uses Mauritius as the platform for this investment. Major international banking groups are well represented in Mauritius and they benefit from the country’s contiguous time zones and cultural links with Europe and Asia as well as its sound monetary policies and actual exchange control policy, making it the most significant international financial centre in the Southern Hemisphere.

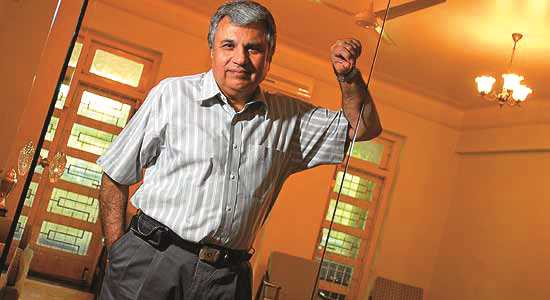

We asked Percy S. Mistry, the international economist, author, businessman, investment banker, adviser to the World Bank and to the Indian Government to contribute his views on the development of Mauritius as an international financial centre. Percy Mistry is, in addition, the founder of Oxford International Associates, a corporate finance and investment advisory firm. We have taken excerpts from a paper provided for this publication by Percy Mistry on Mauritius.

Mauritius: An International Financial Centre for the 21st Century

The emergence of Mauritius as an established, credible, reputable ‘international financial centre’ (IFC) providing an array of International Financial Services (IFS) has been widely documented. Its emergence and growth, from humble beginnings in 1992, have been indisputably impressive. Driven by export orientated services for the global investment community, the financial services sector (including IFC services) now accounts for over 12% of Mauritius’ gross domestic income (GDI) compared to just below 3% of GDI in 1992. If the future unfolds as anticipated, the financial services sector could account for 15% or more of GDP by 2015. The main attraction of Mauritius as an IFC lies in its tax treaties with third countries.

Local expertise has emerged for investment fund administration by Management Companies (MCs), as a result of a requirement that funds in Mauritius must have local administrators and cash custodian. Such funds focus mainly on investment in listed and exchange-traded securities of neighbouring emerging markets and developed markets. But global financial services offered by Mauritian MCs also involve direct investment through Special Purpose Vehicles (SPVs) and joint ventures by Indian and ASEAN clients in China, South Africa, and Indonesia. Apart from these corporate services, Mauritius attracts a small but increasing share of the market for private banking and wealth management undertaken by portfolio managers on behalf of High Net-Worth Individuals (HNWIs) with the proceeds parked in Mauritius and administered by MCs.

Though tax treaties provide the foundations supporting the IFS industry, local MCs compete with other IFCs as well as financial centres in home jurisdictions for business generated by such treaties. That competition has led them to expand their knowledge-base by recruiting from abroad, sending their staff for training/secondment to foreign firms, and investing in continuing programmes of on-the-job training and professional development of their human resources.

Highly tax-efficient use of treaties has been made in designing outward Mauritian Foreign Direct Investment (FDI) in Africa and Indian Ocean e.g. in Madagascar and Mozambique. Financial engineering and structuring by Mauritian MCs and banks has become more sophisticated as IFS knowledge has spilled over into the local capital market. Local investment fund products have become more effective and asset management techniques have improved considerably. The rules of the Stock Exchange of Mauritius (SEM) have been revised to encourage offshore fund listing with SEM adopting global best practices in its listing rules and protocols. Mauritius is well located to provide Private Banking and Wealth Management (PBWM) services to emerging entrepreneurs from India, the rest of South Asia, South-East Asia (Asean) and China (whose HNWIs are also served by Hong Kong and Singapore). HNWIs from the Arabian Gulf are more likely to be served by global banks operating from Abu Dhabi, Dubai, Bahrain, Kuwait, Muscat and Doha. But, unlike other centres, Mauritius could specialise in creating African investment portfolios for these clients; especially as Africa now provides the last emerging market frontier that has not yet matured. The large and rapidly growing pool of HNWIs in Asia would be easier for Mauritius to tap than HNWIs in OECD countries, representing old wealth serviced in other established IFCs.

Another IFS domain that provides significant opportunity for Mauritius is insurance and re-insurance. It is unlikely that global insurance companies would use Mauritius as a regional insurance centre for Africa or for asset-liability management. They are more likely to gravitate to South Africa for that purpose. But there is scope for Mauritius to emulate the success of Bermuda and some Caribbean islands as a regional or global re-insurance centre.

As two-way trade between India-Africa and China-Africa grows, it is bound to create more insurance opportunities, (for goods and the vessels they are being carried in), to be captured by insurance companies based in Mauritius (whether locally, regionally or globally owned) for tax as well as operational reasons. New products (such as catastrophic risk, cyclone risk, and weather insurance) also offer opportunities for IFS growth by insurance companies based in Mauritius, working in tandem with international counterparts to undertake the associated actuarial risk analysis and offer insurance products tailored to African markets and for exploiting insurance opportunities created by rapidly growing Afro-Asian economic interaction”.

Percy Mistry’s insights and observations on the growth and opportunities related to Mauritius are fascinating and compelling. The Cim group of companies, a Rogers enterprise, is one of the largest financial services operators in Mauritius. It is the single largest player in the space of fund administration and international corporate services and offers a unique value proposition to investors looking to use Mauritius as a platform for international investment.

Cim offers an integrated value chain of financial products and services including insurance, asset management, stockbroking, property fund management, fiduciary services, tax advisory services, (as part of the Tax and international network), and a range of credit and asset finance products.

Consisting of 14 companies active in the fields described above, Cim has a strong focus on providing integrated financial services. All of the businesses strive to be leaders in their fields. Its management companies administer assets in excess of US $100 billion and have a client base of blue-chip international corporates from around the globe. In excess of 60% of all foreign direct investment onto the Stock Exchange of Mauritius is routed through their stockbrokerage. Cim was the first asset manager to obtain a Foreign Institutional Investors license from the Securities Exchange Board of India. Cim Property Fund was the first retail and commercial listed property investment to be established in Mauritius. Cim’s credit management business was also the first non-banking financial services provider to be accredited to issue and acquire MasterCard in sub-Saharan Africa. y

SEE FOR EXAMPLE:

Chapter 3 in The Export of Tradeable Services in Mauritius: A Commonwealth Case Study in Economic Transformation by Percy S. Mistry & Nikhil Treebhoohun, Commonwealth Secretariat, London 2009; and Chapters 6-9 in Considering the Consequences: The development implications of initiatives on taxation, AMl and CFT by J. C. Sharman and Percy S Mistry, Commonwealth Secretariat, London 2008. The growth of the Mauritian IFC is documented in several official reports and documents of the Government of Mauritius (GoM), the Bank of Mauritius (BoM), African Development Bank (AfDB), The World Bank (WB) and the International Monetary Fund (IMF).