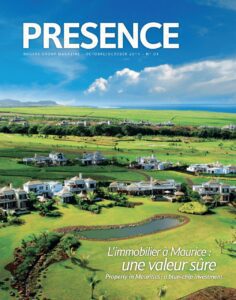

Brett Abrahamse has been in the real estate business for almost a decade and understands the ins and outs of the sector in Africa. He is also a Board member of Foresite Fund Management Ltd, the Fund Manager of Ascencia, the largest listed Property Fund in Mauritius, which he considers a brilliant platform for investors to access the continent’s real estate market.

photos : ascencia

Based on your experience, what are your thoughts on the current state of the African property market?

We have a very vibrant real estate market across Sub-Saharan Africa. Real estate together with infrastructure development is being driven through factors such as the resource boom, a growing working population and increased internal consumption. I foresee a lot of opportunities being created in almost every country and across all sectors of real estate.

Property funds are becoming increasingly popular in Africa. How do you explain this?

Property funds allow the average person to invest in very large, expensive real estate projects. An example of this is in Mauritius where you can invest as little as Rs1,500 (€35) in Ascencia, the property fund set up by Rogers and own your piece of the Centre Commercial Phoenix, the Riche Terre Mall, or Bagatelle – Mall of Mauritius. Also, because there are many investors pooling their money, this allows property funds to afford many assets which assists with diversification for the investors. Historically in many African countries, the government has been the key player in the property market; this is however changing and we are seeing more private property funds in countries such as Kenya, Ghana and Mozambique. I expect this trend to continue.

What return can be expected from investing in property in Africa?

Across Africa, the return profile of a property investment will depict the risk involved in investing in that asset. Yearly real estate returns in more established markets such as South Africa, Botswana and Mauritius are typically in the 8-12% range whilst returns in countries such as Angola, Uganda and Tanzania can be up to 25% p.a. per project.

How does a property investment fund like Ascencia fit in?

As I mentioned previously, Ascencia is a brilliant platform for ordinary investors to access the real estate market in Africa. Funds like Ascencia are well managed and have very strict corporate governance protocols in place to protect the investors. Ascencia also has professional property managers and asset managers looking after the portfolio – this allows for investors in the fund to maximise their return and manage their risks. In the future, Ascencia will hopefully also look to expanding outside of Mauritius into the rest of the continent – this will give investors access to the real estate boom taking place.

What are the opportunities that can be looked at and what are the pitfalls that must be avoided?

For me, the biggest opportunity exists in retail property. We are seeing the emerging middle class growing exponentially. Most of these people are brand conscious and have a lot of disposable income. These people however in countries such as Mozambique, Uganda and Tanzania do not have the fancy shopping centres and entertainment areas to visit – an opportunity lies in creating these spaces. As with any investment, there are risks. The key risk in Africa is the issue of land ownership and title. Once this is overcome, an investor must negotiate each country’s unique tax and investment policies as well as local government approvals for construction.

What is your forecast for the development market in Africa in the medium to long term?

I think we have only seen the start of the African real estate boom. As more private capital flows into Sub-Saharan Africa, so will the demand increase for real estate products. Every new company that sets up office requires a new office block and every new shop that wants to open needs some space in a shopping mall. This presents a massive opportunity for real estate developers and investors. Those who have patience and persistence will succeed.

There is also a perception that investing in property in Africa is an arduous administrative process. How true is this?

Developing real estate around the world is an administrative process – this is not only limited to Africa. However the remoteness and differing cultural barriers of certain countries/cities make this administrative process much more difficult. If you are patient and thorough you will be successful in Africa. It is also important to partner with respectable and supportive local partners.

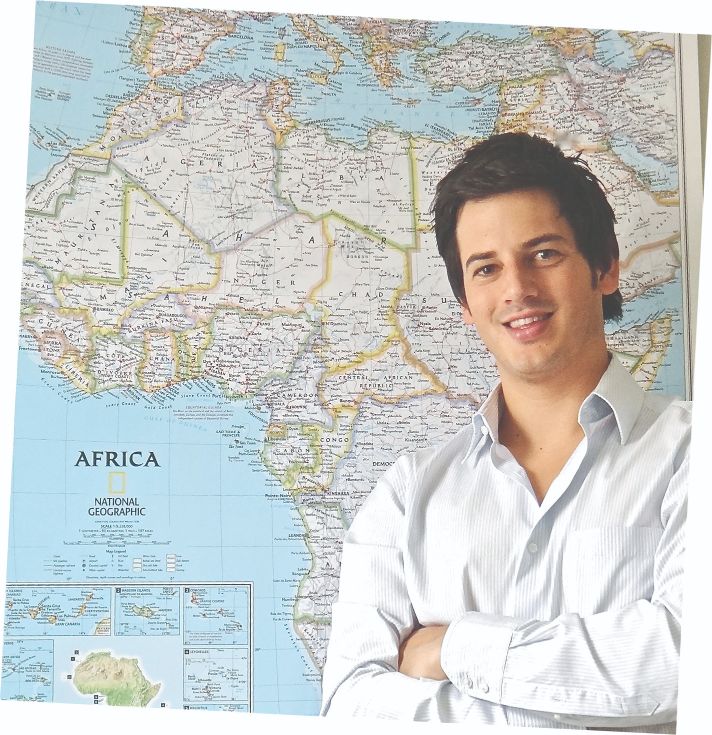

A promising young real estate professional

Brett Abrahamse, aged 30, has worked within the African real estate and asset management industry

for the past 9 years. He is currently a director at Terrace Africa, which has a niche property development strategy in Southern African Development Community (SADC) countries like Mozambique, Zambia and Zimbabwe, where it plans to build small retail projects in secondary towns. Prior to joining Terrace Africa, Brett was head of business development for Liberty Properties. He was part of the team that listed Letlole La Rona, a variable rate loan stock company on the Botswana Stock Exchange and successfully set up contracts for new business in Zambia, Mauritius, Botswana, Mozambique and Swaziland. Brett holds a B.Comm Honours Degree in Financial Analysis from the University of Stellenbosch and has attended the Property Development Programme at the University of Cape Town Business School.

becoming a major player in Africa

Modelled as a Real Estate Investment Trust (REIT), Ascencia was set up in 2008 and is one of the largest property companies listed on the Development & Enterprise Market of the Stock Exchange of Mauritius. The fund’s objectives are to provide dividend income and long-term capital gain to its shareholders by acquiring properties that provide both rental income and potential for growth in value. The fund’s ambition is to remain the dominant player in Mauritius and become a major property investment fund in Africa.