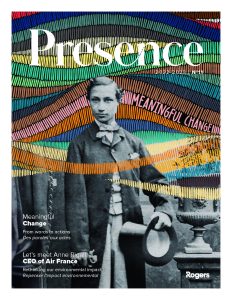

Since 4 October 2016, Rogers Capital has officially evolved into a FinTech focused brand, harnessing the power of technology to make financial services more agile, efficient and trustworthy. The entity’s business segments now combine world-class financial expertise with cutting-edge technology to provide sophisticated business solutions that are tailored to their clients’ needs.

photos : rogers capital image bank

Rogers spearheaded the movement into financials services in Mauritius at the start of the 1990s and the Group is now accentuating its presence in the sector with the launch of Rogers Capital. The new brand serves to bring together the Group’s involvement in financial services, with a focus on Fin Tech, an economic activity using technology to make service provision more efficient. The FinTech market is growing in importance throughout the world. Amongst others, the activities of Rogers Asset Management, the services of Enterprise Information Solutions and Kross Border’s global business services have now been brought under one roof. Emphasising their complimentary and importance, Corporate Services, Technology Services and Financial Services report to Managing Partners Didier Lenette, Kabir Ruhee and Marc Ah Ching respectively.

1

COMMON PURPOSE

3

COMBINED EXPERTISE

305

EMPLOYEES

1200

CLIENTS

As Rogers’ CEO, Philippe Espitalier-Noel, comments, “Our financial services and technology sectors have grown considerably. We have worked over recent months on the creation of a new brand identity for Rogers Capital, which will combine our strengths and capacities in both sectors and, with the addition of new service layers, make us a leading player offering a unique range of solutions in the FinTech sector both in Mauritius and beyond.”

Rogers Capital is relying on a cross-sector approach to the three sectors to enhance its range of services. Its vision is to combine world-class financial expertise with the latest technology in order to provide cutting-edge solutions to help strengthen the position of businesses, institutions and individuals.

It is structured to develop innovative business ideas and solutions which open the door to new growth opportunities through the creation of new products. Its strong and closely-knit team of some 300 professionals brings together a wide range of expertise, knowledge and experience, providing the company with the capacity needed to act in the best interest of their clients. The team also has the necessary flexibility to accurately assess situations and circumstances to the benefit of each and every client.

The ultimate aim is to enhance the client experience, with a business model that is entirely customer-focused. Rogers Capital is engaged in an in-depth transformation of the current financial and business services landscape, positioning itself as a discerning integrated Fin Tech operator, understanding the needs of a client operating on a global scale.

Corporate Services

Rogers Capitals’ corporate services offer a full range of professional trust services, including company administration and domicile, accounting, and both fund and captive company administration. They enable investors such as companies, financial institutions and high-net-worth individuals from around the world to add to their international presence through the channelling through and setting up of their added-value activities in Mauritius or by using the jurisdiction as a platform for investing in other countries, mainly in Asia and Africa.

Technology Services

The technology services sector provides cutting-edge solutions to meet companies’ complex professional needs. It offers the best flexible software and integrated solutions, as well as top quality services, to enhance productivity and efficiency. Its extensive portfolio of applications comprises a full set of technologies suitable for medium and large companies.

Financial Services

Financial services can provide individuals and institutions with a wide range of specialist management and investment advisory services in the main asset categories. The sector also offers wealth management consultancy services, including portfolio management, financial advisory and other transactional services, to high-net-worth individuals and families.