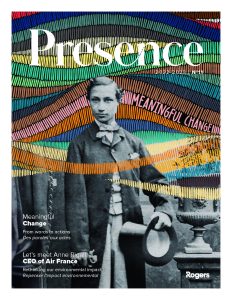

Marc Ah Ching, Didier Lenette & Kabir Ruhee

Managing Partners - Rogers Capital

photos : lynn forget

In the synergy to the found in the linking together of the expertise found in Rogers Capital’s three centres of activity – Corporate, Technology and Financial – their Managing Partners foresee very promising FinTech market prospects.

What is the reasoning behind this grouping?

Kabir Ruhee (KR): There is a natural complementarity that the Group wishes to exploit and develop. Information and digital technology is increasingly used in the financial services sector. They form the basis of new business models, add a positive new element to investment routes and have a growing impact on what clients experience.

Marc Ah Ching (MAC): The financial sector is one of the main pillars of the country’s economy. Indeed, Rogers Capital’s mission is to consolidate the Group’s position in the sector by grouping together our three related professional activities. With a closely-knit team and Rogers’ values of leadership, dynamism and responsiveness, we will be proposing a portfolio of services that, of its kind, is unique here.

Didier Lenette (DL): In fact, it’s what we’ve been doing informally for quite some time but now it’s being done in a structured and integrated manner. When this kind of restructuring takes place, we often talk about things like cost or efficiency synergies. For us it’s a real synergy in the portfolio of services we’re offering our clients. It’s at the very root of our thinking.

How have your teams responded to the changes?

DL: The concept and the project itself have been welcomed very favourably. Rogers Capital’s strategy

has been developed with our management teams. They’ve been enthusiastic, even more than us perhaps, and they see the future very positively.

KR: I have the advantage of having previously worked with both Marc and Didier. We get on very well together, especially as we share the values of the Group. The teams also get on together and I strongly believe in this linking together of our expertise.

What will clients gain from this link-up?

KR: Straightaway there are cross-operational business opportunities as global business companies are being encouraged to establish more substance in Mauritius. There are also a number of development projects being studied. As a result of their innovative aspects, these initiatives will benefit from the various components and skills Rogers Capital now assembles. So watch this space!

DL: In our industry, Offshore Management Companies (OMC) offer fairly similar services. We are differentiated from our competitors by the integrated portfolio of services we offer. Information technology, cloud computing, corporate finance, connectivity and the outsourcing of back-office activities (like telemarketing and accounting, pay and recruitment services) are all integrated within our portfolio. Nowadays we can offer everything a client might need within a single set-up and we intend to go even further. As far as I know, no other OMC offers such panoply of services. Moreover, client feedback is already very positive, which bodes well for the future.

MAC: It’s all about offering existing and potential clients a wide range of services from under one roof. With the marriage of our Corporate, Financial and Technology sectors we can broaden our horizons in offering our full range of expertise to our clients. For example, in the case of Wealth Management, we can provide them with optimal structuring solutions together with expert management facilities.

How will this all benefit other Rogers’ sectors?

DL: We’re already working closely with the Logistics, Aviation and Property sectors. Our clients are business people. They are frequent travellers (especially in Africa) and some of them are looking for luxury villas, office space and sometimes sites in commercial centres. Others want to know more about the Group’s traditional activities. The management and co-ordination of all these will be even better through a combined operation structured to exploit a pool of complementary skills.

KR: In the ten years I’ve been with the Group, I’ve never seen such a strong entrepreneurial spirit as in the last two or three years. The management team is united around its captain. There are growing investment opportunities and everything – from feasibility studies to finance and risk analyses, not to mention the legal complexities involved in each case – is carried out by professionals who are only improving with time. In so far as I can be objective, it seems to me that Rogers is going from strength to strength.

MAC: Now that they are integrated, our services will add a great deal to the Group overall. Our approach is to optimise our line of activity in an innovative manner by offering new services such as efficient treasury management and forex transactions in order to optimise our financial resources.

How do you see the future of Rogers Capital?

KR: We’re very optimistic; the future is promising. Ventures that have brought together their IT and financials services are not only very profitable but also and above all have been pushing forward the boundaries to investment, wealth and credit management and so on. In all this we want to position ourselves as the trailblazer in the country and the region and, why not, in the African continent.

DL: It’s strikingly obvious that in bringing technology services in with financial services, setting an example to our clients, it gives us a sure advantage. We have no doubt that it will give us a competitive edge so far as client service, new project development and our ability to respond to client requirements are concerned both internationally and around the clock seven days a week.

MAC: We’ve already assembled the pieces of the jigsaw, now we just need to cement everything together. It’s a new chapter in fact which is being written in the history of Rogers’ Capital. With a young and go-ahead team, shareholder confidence and a strong entrepreneurial spirit, the sky’s the limit.

Marc Ah Ching

Managing Partner Financial Services

Having headed Rogers’ Corporate Office finances from 2005 to 2011, 49-year-old Marc Ah Ching, a cycling enthusiast who enjoys being out and about in the open air, returns to familiar ground after a five-year break “for some interesting challenges and a new stage in the group’s history.” He will be the Managing Partner of Financial Services, where “we are going to operate in a collegial manner and work together in exceptional partnership.”

Didier Lenette

Managing Partner Corporate Services

Having joined Rogers in 2014, Didier Lenette was initially in charge of internal audit. A 40-year-old golfing enthusiast, he says he is equally enthusiastic at the idea of meeting “new challenges at Rogers alongside his colleagues. Having trained as an accountant and having worked for many years in the global business sector, the Managing Partner of Rogers Capital’s Corporate Services says that “for the moment, I’m all smiles!”

Kabir Ruhee

Managing Partner Technology Services

A 39-year-old engineer, Kabir Ruhee has been working at Rogers for almost ten years. “We’re very excited by the way things are shaping up. We’re about to set out on the development of a new industry in Mauritius and we’re starting out on this adventure with an existing critical mass.” Outside work, the Managing Partner of Technology Services has a deep interest in military history and everything to do with wine.