Rogers’ property investment fund, which has a new CEO in Frédéric Tyack, is continuing its ascent and has set itself new objectives towards the realisation of its future ambitions.

photos : ascencia image bank

In 2014, whilst property transactions declined globally by 6.4%, for the first time in five years, and sector growth slowed in Mauritius, Ascencia has continued to perform well. The largest property fund quoted on the Stock Exchange of Mauritius outperformed the market by 29% in March 2015.

Since its inception in 2008, modelled on a real estate investment fund, Ascencia’s total assets have risen by 280% to Rs5.1 billion (about €132 million) as at 31 March 2015. The fund’s turnover has quadrupled over the last six years, whilst shareholders have received an accumulated return of 111% since it was first listed on the stock market in December 2008.

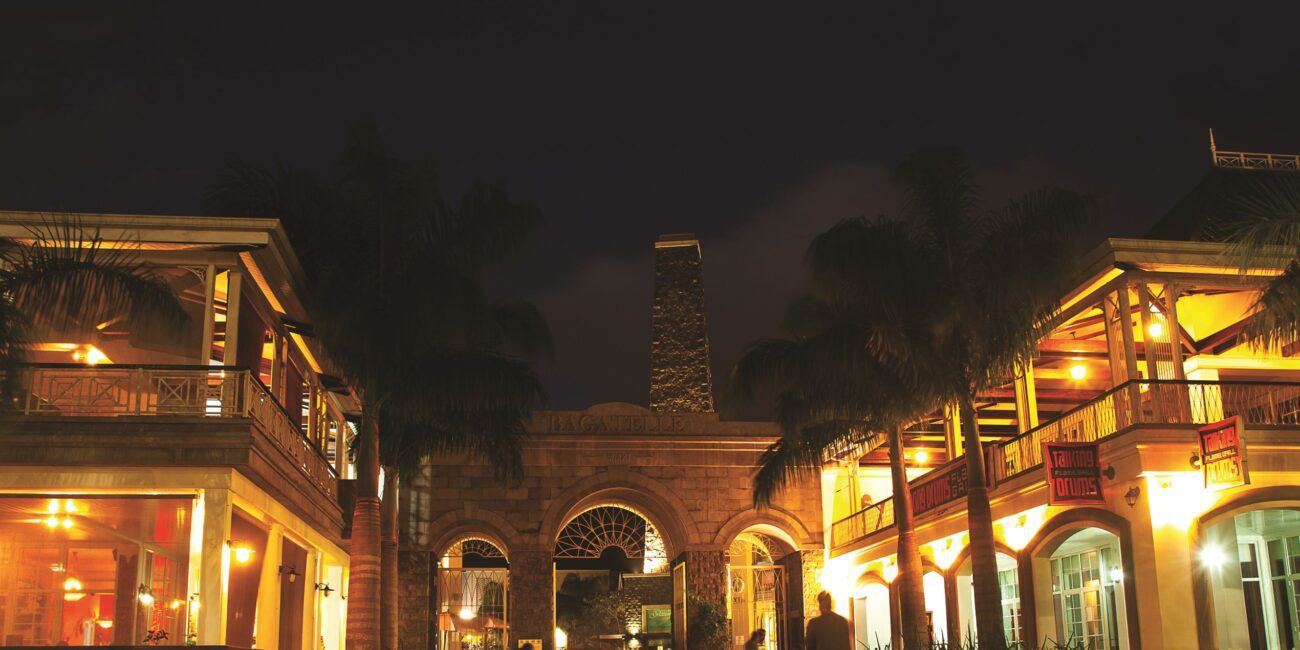

“Ascencia is backed up by a group which is recognised as being financially solid. Moreover, it is the only property investment fund in Mauritius of such a size. Foreign investors also have the advantage of being able to access a very profitable investment vehicle with good profit potential in an attractive fiscal jurisdiction. The fact that the fund is quoted on the Stock Exchange means that the shares are easily traded,” says Frédéric Tyack, who took up the post of Ascencia’s Chief Executive Officer on 1 July 2015. A Chartered Accountant from the Institute of Chartered Accountants in England & Wales, he was previously Managing Director of Bagatelle and EnAtt, the property and asset manager for the fund.

In order to continue to play a leading role in the country and realise its ambition to become one of the region’s main investment funds, Ascencia is currently calculating the funding required to enable further acquisitions in order to strengthen its investment portfolio. This operation should see the fund growing to Rs8.5 billion (about €220 million) and attaining a turnover of Rs1 billion (about €25 million) by the end of 2016. Swan Wealth Managers Ltd, one of the country’s main asset and wealth management companies, has been approached in order to support Ascencia’s and Rogers’ teams on the project.

As investment advisers, the firm examines the costs and risks associated with the project. A cost-benefit analysis and an analysis of the most appropriate financial instruments would be most appropriate are also being conducted in order to determine the best balance between debt financing and capital funding. These will consider several factors, including the company’s cash flow, return on investment and the interests of existing shareholders. Swan Wealth Managers Ltd has also been tasked with ensuring that the project will be completed within a set deadline.

“The fund has a range of assets with a very stable, indeed growing, return on investment. The share price reflects this growth as well as market confidence in the fund,” explains Nitish Benimadhu, Swan Wealth Managers’ Senior Manager-Investments. “It has always maintained the level of liquidity required to meet its needs.” In his view, Ascencia is an interesting investment vehicle as the fund has a dynamic approach and shows constant growth.

Nitish Benimadhu also emphasises that the fund is transparently managed, regularly communicating on its activities. He also mentions that projects already carried out have met with success, including the renovation and extension of the Phoenix Commercial Centre and the Riche Terre Mall, both of which received International Property Awards.

Leading asset and wealth managers

Swan Wealth Managers Ltd is a leading asset and wealth management company in Mauritius, with a 22-strong team possessing a range of specialist knowledge and assets under management of some Rs35 billion (more than €850 million). It is mainly involved in the distribution of financial products, investment advisory and collective investment schemes. The firm’s investment strategies are led by its knowledge of international markets and a large range of investment opportunities. Investors have access to an extensive range of options, including a fund investing in foreign equities, open-ended investment funds and financial products structured according to clients’ financial objectives and the level of risk they wish to take. Swan Wealth Managers also offers asset management services as well as multi-asset strategies including ma mix of shares, bonds and alternative investments.

www.swanforlife.com